Did we ever see any link on those associations web pages telling us THEY are the people behing those validator names ? NO.

Did we ever see some of them (beside random pictures taken in a forum) ? NO.

Do we have any IRL reference of anyone behind those associations ? NO.

Not sure if you have followed the official announcement page but they DID. Please do proper research before trying to spread misinformation.

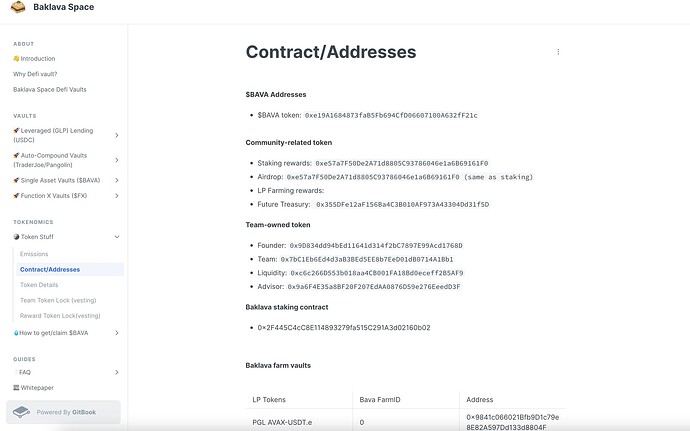

Function X is even listed on Polkachu website.

This is their Delegation Service for FX.

Litecoin Foundation also posted about it before. Keith from Baklava Space is Director of LTC Foundation as well. You can slowly find it on their socials.

Now you understand why I talked about established validators vs random validators - the difference in professionalism can easily be seen by anyone.

Function X also did live events with Baklava, LTC Foundation and many more.

Team’s Address: 1M $FX and 107 ETH accounts for like $280-300k.

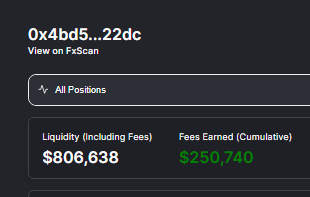

The address listed above in my previous post is the MAIN LP PROVIDER which have not moved since FXSwap was launched.

I’m also aware of the address you gave - it is also being traced by me - Literally got a full automated folder.

There’s still over 200-400k in liquidity removed from community members that I have traced, they even gave me their addresses.

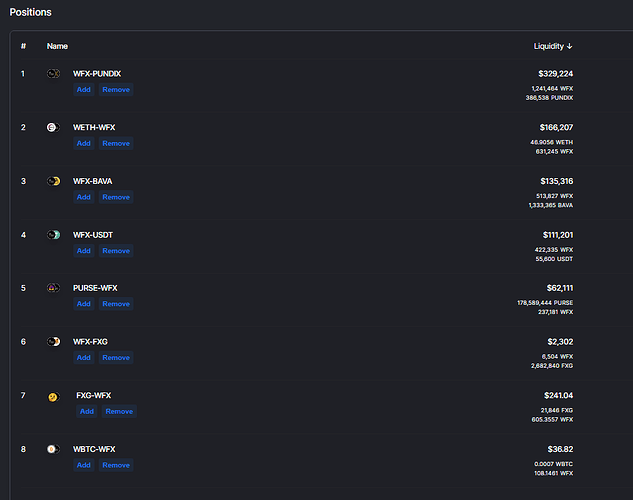

I will give you 1 example of a community member that you know very well but I can’t give his name.

- You know who you are once you see this.

He alone deposited 136k of liquidity - not team, he’s a public validator. I still got many more addresses, like tons.

The way you presented your case is as if all $1.6M of liquidity belongs to team. There are more assets that are not in FXSwap but idling in FXCore.

FYI, there are actually more assets in FXCore that can’t be seen from FXSwap:

- FXSwap only accounts for liquidity provided as seen from TVL. Not idle assets in wallets.

FXCore Assets Stats:

- 866,133.032488 USDT ( Include MarginX )

- 200.176749394096082091 ETH

- 746,711.848684 PUNDIX

- 334,992,079.522 PURSE

- 8,330,142.742 BAVA

- 90.484316 LINK

- 127.360317 QI

- 0.224814 WAVAX

- 0.027353 WBTC

- 3.01 USDC

- 2.5 DAI

Some users could be waiting for the right time to provide liquidity again, most assets are idling right now. FXSwap operates on Uniswap V2, some users know how and when to provide / remove. This is not concentrated liquidity V3, there are so many ways and strategies to do it.