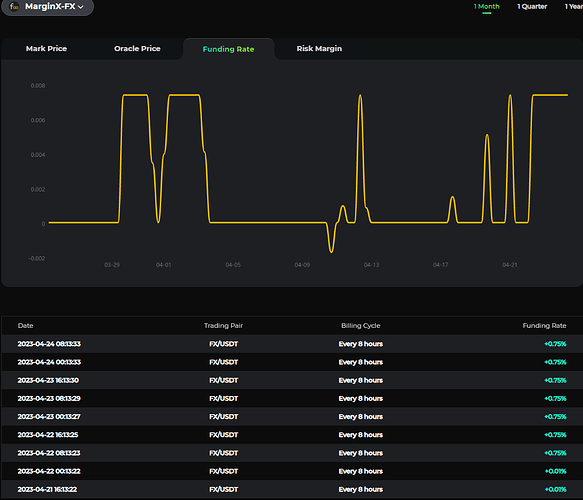

Is there any trick so that I can see when funding I have paid with an account (in Margin X) from the beginning?

You can usually find the amount of the funding fee you paid/earned in the trade details.

But I don’t think there is a standalone page yet where you can view all your current and past funding rates. I think its a good idea to have one for FR farmers since it’s easier to keep track.

I was paying 3€/day funding, after 28€/day and now 120€/day…its something rare

You can check the funding rate history in the dashboard and filter by pair.

0.75% every 8 hour is pretty crazy

There is one issue then. I paying more than 5%

You are paying 5% in funding fee every period?

Maybe it would be better to post a picture or something

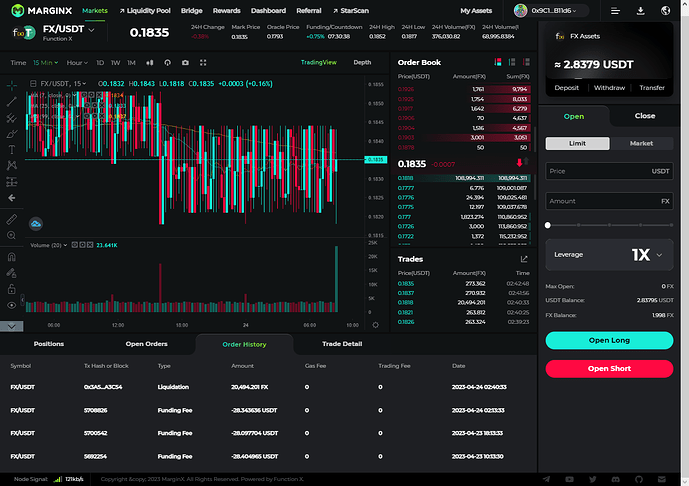

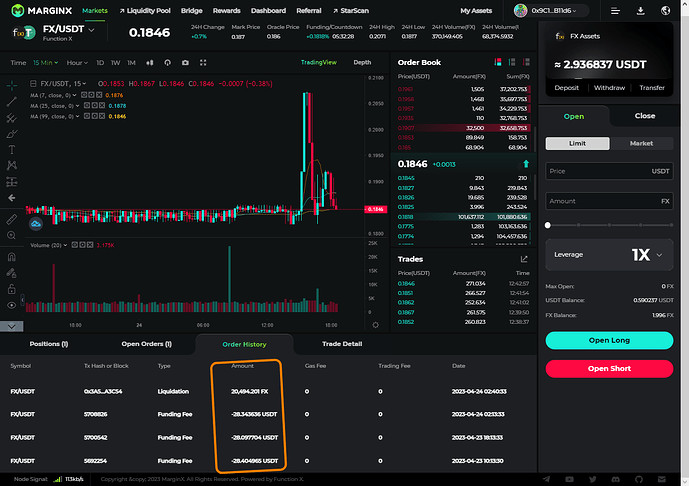

It looks like you were liquidated due to paying too much in funding fees, even though your liquidation price was way below at $0.1668.

How? Breakdown ![]()

- Since MarginX is using isolated margin, every time you pay the funding fee, your margin rate will be closer to liquidation, and once it reaches 100%, it will be liquidated or margin called.

- The funding fee is deducted from your position’s margin since there is no cross-margin.

- To avoid liquidation, always monitor your margin rate and keep it at a healthy level. You can do this by adding additional margin if needed.

- Pay close attention to the funding rates (+/-). While perps have no expiration, that doesn’t mean a position can stay indefinitely without proper maintenance because FR acts as a market equilibrium.

If you trade with leverage, this will increase your risk of liquidation.

Important Disclaimer for #3:

- It is also important to review your strategy before adding additional margin, as the market changes rapidly and so will your strategy. Adding to an already losing position may be unwise, but if you have high conviction in the direction, then you can follow up by adding more margin.

Just remember to think twice and re-consider your options before adding more margin.

- Risk management is important, as the first rule is to:

Always protect your downside - capital preservation. The upside will naturally come.

You can read MarginX’s FAQ about liquidation under “Making Trades” and ping me if you have any questions since I wrote those. ![]() https://marginx.io/faq/

https://marginx.io/faq/

Since I don’t have your data, only the MarginX team can help you check if you are really paying 5% in funding fees every 8 hours.

Currently, it is 0.75% every 8 hours, which is pretty tilted since the long/short ratio looks skewed.

Just wait for the MX team to get back to you. They will check it out for you.

ok thanks, i go to sleep now.

Dm me … I’ll get dev to check.

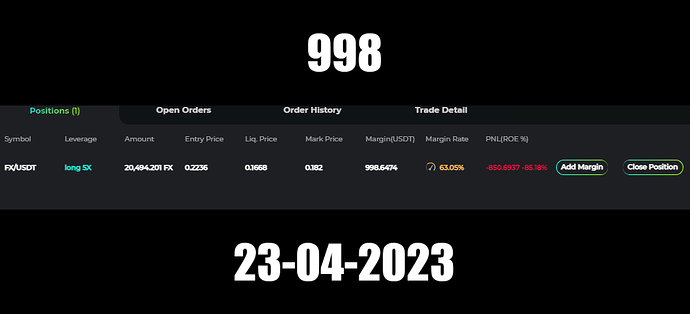

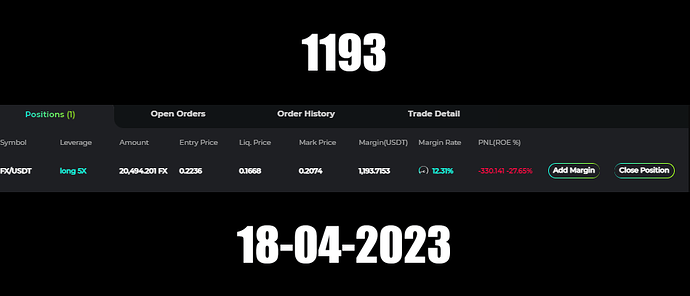

Entry: 0.2236 (Long)

Mark: 0.182 (Negative)

Liq: 0.1668

Margin Rate: 63.05% (Med Risk Zone)

Your margin rate was hovering around 60-65% but the sudden change in the long/short ratio the past few days caused the funding rate to go from 0.01% → 0.75% every 8 hours since 22th April.

Main cause:

Every time you pay the FR, your margin rate will get closer to liquidation → 100% which it did today. The 5x leverage was the additional amplifier that accelerated the liquidation as well.

It was a combination of unrealized negative losses and a high funding rate that caused the liquidation.

- It was actually safe even though it was negative (60%+ margin rate) but the FR went up to 0.75% since 22th which was the main cause of the liquidation.

About this i understant the risk and i undestant why margin was closed and liquidated.

But i dont understant why funding much more than 0,75% so close to 3% each time.

Yup, that is the part where MarginX will have to find out.

The funding will typically be skewed when there is a significant difference between the number of longs and shorts. In this case, Long > Short

The dashboard doesn’t show the ratio of long to short for active positions, so we can’t check to confirm. Users can only check the open interest and orderbook depth but not active position ratio.

An interface would be needed for the balance sheet and closed operations that is clearer and more specific, denominated in dollars.

Also, to answer your question about why it’s around 3% in funding rate each time is because of 5X leverage.

0.75% x 5 = 3.75%, leverage is an amplifier.

- Leverage multiplies the funding rate.

You are losing 3.75% of your margin every 8 hours, or 11.25% per day for the past few days.

I would like there to be an indicator of the total that I have paid in funding.

I agree with that. It’s a common feature on perp exchanges, actually.

Usually there is a page that shows:

- Total Rebates

- Total Commissions

- Funding Rate History

- Funding Payment History

I put more margin and perform more operations you will add to the first operation.

What I no longer know is if I have paid more than $1000 in funding.

I really don’t even know how many dollars I put into it.