A 77,777 $PUNDIX reward for PUNDIX-ETH Uniswap V3 liquidity providers to grab

Hi Pundians,

It is a great time to be a Pundian! Why? Because there are 77,777 PUNDIX tokens in the mining farm for you.

Details for the Program

1)Who: Liquidity suppliers of PUNDIX-ETH pair on UniswapV3 @ 0.3% fee level

a. Token 0 Address (PUNDIX): 0x0FD10b9899882a6f2fcb5c371E17e70FdEe00C38

b. Token 1 Address (WETH): 0xC02aaA39b223FE8D0A0e5C4F27eAD9083C756Cc2

c. Fees level: 0.3%

d. Pool Address: 0xD050430dd432876cF5622fF60c4Dc106b64fA753

** if you have supplied liquidity for the PUNDIX-ETH pool, the router would have automatically converted your ETH to WETH for you.

2) Liquidity Mining Start Time: Friday, 12 November, 2021 9:00:00 AM (GMT+8)

3) Liquidity Mining End Time: Saturday, 11 December, 2021 9:00:00 AM (GMT+8)

4) Duration: 30 days

5) Reward: 77,777 PUNDIX (this reward will be distributed based on the duration you stake in this farm, and the amount of active liquidity you have staked in UniswapV3)

**You may only start staking in the farm when the program has started.

Summary

We would like to invite $PUNDIX token holders who have provided liquidity on UniswapV3 to stake your liquidity provider (LP) token in our liquidity mining farm and earn $PUNDIX as rewards!

In this article we will discuss the basic concepts of decentralized finance (DeFi), such as liquidity mining etc, UniSwapV3 and EtherScan. If you are already a pro at DeFi, UniswapV3 and Etherscan, you may proceed directly to this link and start staking! However, reading through the whole article will definitely help you better understand how DeFi works.

We will be providing the liquidity mining incentives for $PUNDIX/$ETH pairing in UniSwapV3. The farm is incentivized with 77,777 $PUNDIX for a limited time only. This is a way to accumulate additional PUNDIX tokens via a liquidity mining farm if you are a long-term holder.

To be eligible, you will

-

Provide liquidity for PUNDIX-ETH pair in UniswapV3

-

Provide your PUNDIX-ETH liquidity LP token to the liquidity mining farm during the incentive period

NOTICE

Participating in this program requires ETH for the gas fees and providing PUNDIX and ETH liquidity on UniswapV3 if you have yet to do so. The gas fee you incur may be relatively higher during peak period. The gas fee will be paid to Ethereum miners, NOT Pundi X. Please DYOR before participating in this program.

What is DeFi?

DeFi has become a mainstay in the crypto industry since its boom in 2020. Decentralized finance is essentially financial applications that a centralized body would provide (Banks, Financial Institutions), but is now offered in a decentralized manner. Popular DeFi applications include Decentralized exchanges (DEXs), Lending Platforms and Liquidity mining.

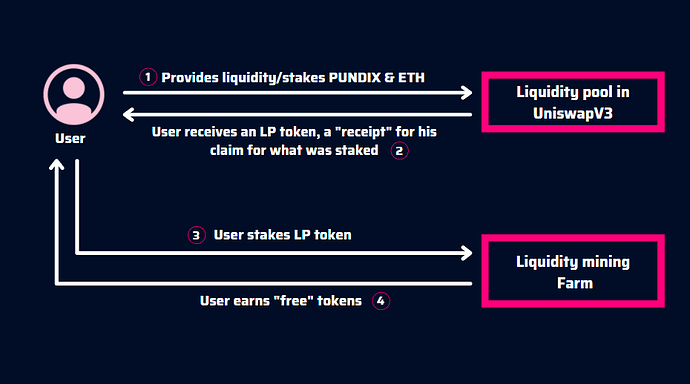

Launched in March 2021, Uniswap V3 is a decentralized exchange that allows people to provide liquidity and to swap between different cryptocurrencies on the Ethereum network. Liquidity mining is where users are incentivized to stake their LP tokens (from staking in DEXs) into farms/DeFi applications to earn free tokens which are incentivized by the platform or the farm owner.

If you have PUNDIX ERC-20 tokens and ETH, it is an option for you to earn fees by providing $PUNDIX and $ETH liquidity to the UniswapV3 pool through this interface.

What is UniswapV3?

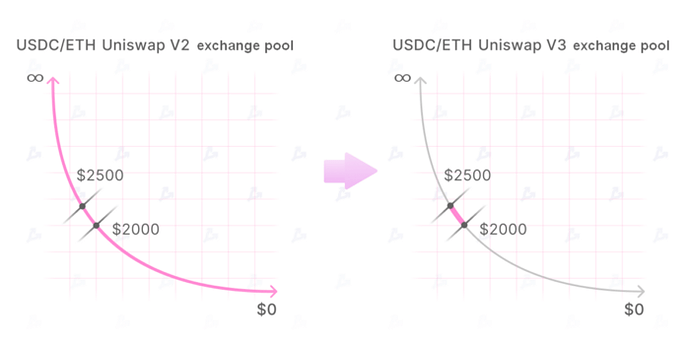

There are many DEXs that have sprung up over the course of a year, Uniswap, Sushiswap, 1-inch…They all have quite similar concepts and all run on an automated market maker (AMM) algorithm. For more information on AMMs, kindly refer to this article. Most of the DEXs faced one underlying problem, capital inefficiency because if prices were stable, trading pairs would only be traded within a given price range. Therefore the rest of the curve where liquidity is being provided would not be “touched” and hence the issue of capital inefficiency.

Then comes UniswapV3 which is the miracle drug to the capital inefficiency problem. In UniswapV3, liquidity providers are given the option of setting their upper and lower price bands otherwise known as ticker ranges. In UniswapV2, or most other DEXs, liquidity providers will typically receive an ERC20 or fungible LP token (a receipt for their claim of liquidity provided). In UniswapV3; however, because each price band is unique, liquidity providers will in turn receive an ERC721 or Non-Fungible Token aka NFT. Do not confuse this with NFT collections like Cryptopunks, CryptoKitties or NBA Topshop. The NFT you receive from Uniswap V3 as an LP token is a legitimate claim to the liquidity dollar value you provided in the UniswapV3 pool, NOT AN ART PIECE! as some of us might otherwise associate it with.

Disclaimer

Providing liquidity isn’t a passive strategy to be profitable long-term

Oftentimes, HODLing can reap greater yields compared to yield farming

Providing liquidity is a good form of reaping yields in muted volatility environments

With Defi comes the age old problem of impermanent loss. As a liquidity provider, your position may fall in value with respect to either asset. In the case of UniswapV3, this is more profound because of concentrated liquidity and the upper and lower ranges you will be setting when you provide liquidity. Let’s say that the price of PUNDIX-USDC is currently $1.00 and you provided liquidity for the range of $0.95 — $1.05. The amount of liquidity you provided is 100 PUNDIX and 100 USDC and you make up the entire pool. If the price of PUNDIX-USDC stays within the $0.95 — $1.05 range, you will be accruing fees both on UniswapV3 and also in our liquidity provider incentive. If say PUNDIX-USDC price goes beyond $1.05, to $1.5, you will stop earning fees and all your PUNDIX will be converted to USDC, this results in impermanent loss.

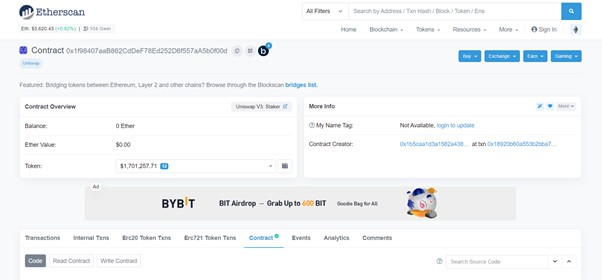

What is Etherscan?

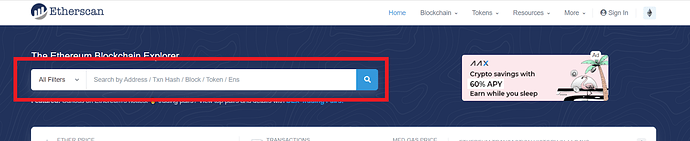

For the most part, we will be using Etherscan as a tool to stake in the incentive farm.

Etherscan is a block Explorer or a search engine that provides users with a way of checking Ethereum’s blockchain data. What makes it more than just a block explorer is that it allows users to interact with Ethereum’s smart contracts. In general, what we would be doing is inputting the smart contract address in the search bar.

Then navigate to the “contracts” tab and then click on the “read” or “write” button as instructed by the user manual.

If this is how you look now…

I would suggest reading up more on liquidity mining, DEXs and Uniswap before moving further.

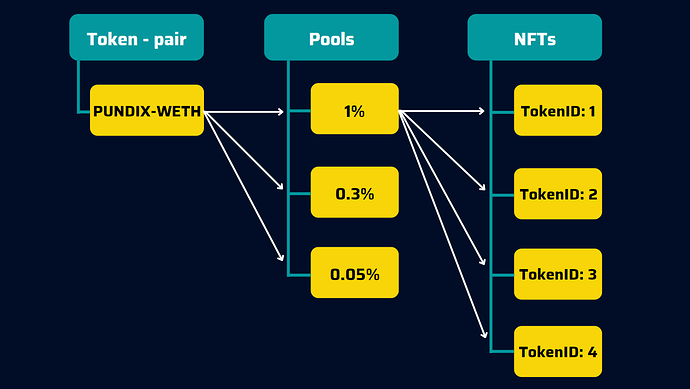

If you are interested in the mapping of token pairs to pools to NFTs, please look below.

Mapping:

- 1 token-pair will have 3 bins or 3 pools

- 1 pool can have multiple NFTs (because of each unique upper and lower ticks/price bounds)

Calculation within (intra) each pool will be done by UniswapStaker based on the product of the length of time and liquidity you stake inside your upper and lower ticker ranges. For more information, you may refer to the UniswapV3 whitepaper or their official website. Additionally, you may also refer to Liquidity Mining on UniswapV3 or UniswapV3 liquidity mining docs(official UniswapV3 docs) or the UniswapV3 Pool code for more info.

Glossary of terms:

- Stake/staking (verb): the act of putting your coin/token in a farm/pool or even a validator to earn rewards

- Liquidity pool (noun): a place where users supply liquidity to eg. UniswapV3 PUNDIX-ETH liquidity pool (LP).

- Supplying liquidity (verb): the act of supplying liquidity to a liquidity pool eg. supplying PUNDIX and ETH to the UniswapV3 PUNDIX-ETH liquidity pool and receiving LP tokens.

- Liquidity mining farm (noun): using your LP tokens / NFT certificates received from supplying liquidity to a liquidity pool to stake in a liquidity mining farm and earning even more rewards.

- Liquidity mining (verb): the act of using your LP tokens to stake in mining farms to earn more rewards

- ERC20: a token standard for fungible tokens i.e. tokens that are standardized and cannot be differentiated from one another

- ERC721: a token standard for non-fungible tokens AKA NFT i.e. tokens that are unique to represent an art piece, real estate or a unique range, liquidity and fee for UniswapV3 pool.

NOW, the part you’ve been waiting for! How to stake and earn rewards, unlike Squid Game where the participants have to put their life at STAKE.

Step by Step Guide to liquidity mining

The tools that you will be using are Etherscan and Uniswap.

CLICK HERE and participate to earn!

Make sure to follow us on Twitter, and our official forum to get the latest updates!