Epoch 3: Maker Liquidity Pool — New Platform Fee Reward

Summary

Participants of the upcoming Maker Liquidity Pool (“Maker LP”) shall be entitled to 60% of MarginX’s net platform (trading) fee and the rewards shall be distributed in $FX on a weekly basis.

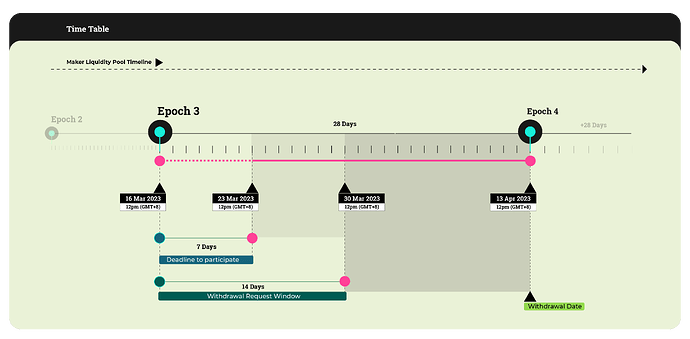

Duration: 16 March 2023 – 13 April 2023

Maximum pool cap: 750,000 USDT (600,000 USDT allocation on Ethereum, 150,000USDT allocation on f(x)Core

Please note that: f(x)EVM pool will kick start on 22nd March 2023)

Overview

The MarginX 100-Day Incentive Program will be coming to an end on 11 March 2023. The team will revoke the $FX reward system and replace it with the distribution of a portion of MarginX’s net platform fee in $FX, on a weekly basis.

Participants shall share the risk and reward from the performance of the Maker LP proportionally, and in return, a portion of the net platform fee shall be shared among the participants.

In short, participants will be able to provide liquidity, and in turn earn a portion of MarginX’s net platform fee.

PLEASE TAKE NOTE THAT, USERS MIGHT LOSE THEIR FUND (NO 100% GUARANTEE PRINCIPAL)

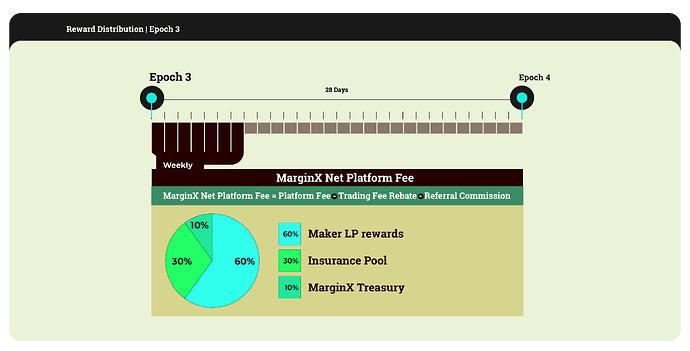

MarginX Net Platform Fee Distribution

MarginX has made a net platform fee of over 35,000 USDT in the past 2 weeks (14 Feb to 28 Feb), with an APY of 3.54%.

MarginX net platform fee = Platform fee - Trading fee rebate - Referral commission

Distribution of MarginX net platform fee:

60% goes to Maker LP rewards

10% goes to Insurance Pool

30% goes to MarginX Treasury

MarginX Maker LP Rewards (New!)

New Maker LP rewards = Trading profit/loss + 60% of net platform fee

For example:

60% of net platform fee is 60,000 USDT, monthly price of $FX is $0.2, MarginX will buy 300,000 $FX (60,000 / 0.2) from the open market and distribute it to all participants.

Alice contributes $300,000

Bob contributes $200,000

Charles contributes $250,000

Alice shall get 120,000 $FX (300,000/750,000 * 300,000 $FX);

Bob shall get 80,000 $FX (200,000 / 750,000 * 300,000 $FX);

Charles shall get 100,000 $FX (250,000 / 750,000 * 300,000 $FX)

However if the maker liquidity pool lose $10,000 on epoch 3, the loss shall share among the withdrawal parties

For example, if Alice and Bon made the withdrawal request (300,000 and 200,000)

Alice will only get back $294,000 (300,000 - (10,000 * 300,000 / 500,000) )

Bob will only get back $ 196,000 (200,000 - (10,000 * 200,000 / 500,000))