Devs are still checking on this … they’ll do a calculation and revert by next Wednesday. Thank you for your patience.

Hi there, thank you for your patience!

We have received feedback from the community over the way losses were handled in Epoch 3, and we listened. Although the calculations were laid out in our T&Cs, we understand how some of our members would feel aggrieved by the outcome.

After conducting an in-depth analysis, we have agreed to implement, retroactively, a fairer way for the losses to be distributed. This would mean lower losses for most of the users who submitted withdrawal requests during Epoch 3. We will also open up an additional period for these users to withdraw any remaining tokens from their initial deposit.

This additional withdrawal period will be announced on 25 April 2023, once we finalize the backend upgrading.

Epoch 3 Stats:

Maker LP Status

Individual Loss: 7.86%

AI Bot Status

Individual Loss: 5.49%

------------------------------

We have also made the following changes moving forward.

At Present:

The current market practice for many Liquidity Pools involves converting losses into “debts”. Only users who submit withdrawal requests for that epoch will share the cost of these “debts”.

This mechanism allows the pool to “rebalance/restabilize” itself, thus penalizing those requesting withdrawals if the pool suffers from any losses.

This calculation works the same way for wins and profits. Code as below:

New Proposed Improvement:

To ensure a fairer and improved system for all, MarginX will be implementing a different practice for Epoch 4 and beyond. Any loss (or debt) will be proportionally borne by each individual wallet address in the pool, instead of penalising only those who submit withdrawal requests. Likewise, for profits.

Thank you once again for your patience and support.

We believe this is the right and fair thing to do, and we will continue working to create better products for the community!

Thank you for your work. I know it’s beta version and still working on to build the better version as possible. I’ll support you by letting liquidity in the app.

Cheers.

Rest assured that we will roll out more products once our latest Roadmap is completed. (We’re almost there!)

Thank you for your support!

Cheers!

Hello! Please tell me, “we agreed to implement a fairer way of distributing losses retroactively” does it mean that I can hope for partial compensation for my incommensurable losses, or is this money lost to me forever?

Hi,

Based on the pool which you’ve participated in, the loss amount will be as follows (instead of minus 80% as you mentioned earlier).

Epoch 3 Stats:

Maker LP Status

Individual Loss: -7.86%

AI Bot Status

Individual Loss: -5.49%

After the system upgrading, you will see the adjustment after connecting your wallet.

Great! Thank you, I was always sure that you would find the optimal solution, I fully support you!

After the upgrade I think our losses will be in USDT and I hope when there is a profit it will also be in USDT and not FX because it’s becoming a little bit confusing now.How sure are we this market makers are not just gambling with users funds because they don’t bear any of the loss and still they get to get commissions in the months of profit.

Hello,

Thank you for the questions.

Will break into 2 parts as below…

Yes. All profits/losses will be in USDT (ERC20/FXCore) based on user’s initial deposit.

Only rewards are based in $FX (using 60% of trading fees collected and buying from market) in this Maker Liquidity Pool.

After closely monitoring the market conditions, we have identified that the current beta version of the Maker Liquidity Pool system is not meeting the demands of the market. The mechanics of the liquidity pool system are not providing a balanced experience for both liquidity providers and users, which is hindering the overall performance of the system.

To address this issue, our team is committed to upgrading the current liquidity pool system in the next epoch. We will be working closely with our institutional partners to gain insights into the specific challenges faced by larger market participants.

Our team is dedicated to ensuring that Maker’s liquidity pool system is the best in the market, and we are confident that by working with our institutional partners and implementing the necessary upgrades, we can achieve this goal and provide a more balanced experience for everyone involved.

Cheers!

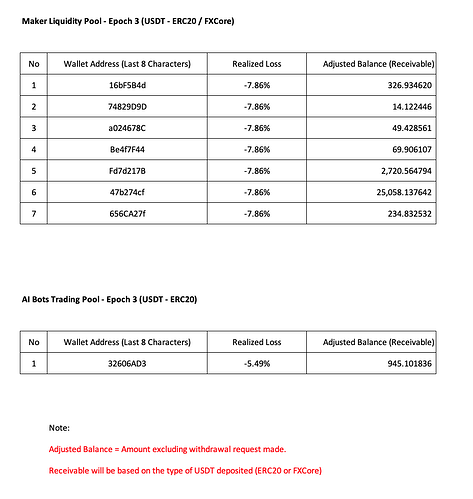

These are the wallets requested withdrawals for Epoch 3 and their remaining tokens (adjusted balance) receivable.

We will further update on 25 April 2023 on withdrawal procedure.

Thank you for your patience and support once again.

Thank you for clarifying things up.Personally I’m not interested in the Maker Pool because the risk involved is too much and with a loss of 7.86 Percent in the first Epoch alone it’s not looking good.I just will prefer to provide liquidity so maybe next Epoch there should be a separate pool for each and people can decide which one they want to participate in.Nothing is known about this market makers so how sure are we they won’t be doing thing best to their own interest and in the end they are also not liable for any loss,I think this model is very risky and with what we have seen in crypto world recently I wouldn’t trust anyone to manage my funds like that.

We appreciate your feedback and understand that the MarginX Liquidity Pool may not be suitable for all users’ needs.

However, we are committed to building a comprehensive infrastructure that caters to the diverse requirements of the crypto market.

The MarginX Liquidity Pool is just the first step in our journey towards providing a broader range of services.

As we continue to develop and expand our platform, we will take into account the feedback and suggestions from our users to create a more inclusive and versatile ecosystem that meets the needs of all market participants.

We are excited about our roadmap for the future and are confident that there will be something for everyone.

Thank you once again for your feedback.

Hi all,

All (adjusted balance) receivable has been transferred to your wallet address directly.

Do check your wallets for balance and transaction records.

Once again, thank you for your patience and your support.

Cheers!

Maker Liquidity Pool performance report (epoch 4 - first half )

Summary

Maker liquidity pool makes a trading profit of $1050.30 (0.267%);

Epoch:4

Duration: 21/4/2023 - 27/4/2023

Reporting Date: 2/5/2023

Part 1: Balance

| Address | Trading Pair | Initial Balance | Current Balance |

|---|---|---|---|

| 0xF937CE482E067B315446A1f63E48FFF599C788DB | BTC-USDT | 131,043.99 | 130,799.35 |

| 0x83ED913a3f7adC173f05e3bF60b5AA9dfaBFc3e6 | ETH-USDT | 133,564.40 | 133,475.20 |

| 0x17C2003c23604dC67845947A7514FddFB427cfe9 | FX-USDT | 127,812.58 | 128,759.61 |

| 392,420.97 | 393,034.16 |

- Key parameters (cumulative)

| Name | Address | Trading Pair | Trading Volume | No. of Transactions |

|---|---|---|---|---|

| Maker LP | ||||

| Maker LP BTC | 0xF937CE482E067B315446A1f63E48FFF599C788DB | BTC-USDT | 22,406,958.70 | 10,009,865 |

| Maker LP ETH | 0x83ED913a3f7adC173f05e3bF60b5AA9dfaBFc3e6 | ETH-USDT | 8,764,437.83 | 10,670,202 |

| Maker LP FX | 0x17C2003c23604dC67845947A7514FddFB427cfe9 | FX-USDT | 3,243,604.46 | 9,598,128 |

| Total | 34,415,000.99 | 30,278,195 |

- Profit and loss (cumulative)

| Address | Trading Pair | Opening Bal | Closing Bal | PNL |

|---|---|---|---|---|

| 0xF937CE482E067B315446A1f63E48FFF599C788DB | BTC-USDT | 130,905.17 | 130,799.35 | -105.82 |

| 0x83ED913a3f7adC173f05e3bF60b5AA9dfaBFc3e6 | ETH-USDT | 133,316.18 | 133,475.20 | 159.02 |

| 0x17C2003c23604dC67845947A7514FddFB427cfe9 | FX-USDT | 127,762.51 | 128,759.61 | 997.10 |

| Total | 391,983.86 | 393,034.16 | 1,050.30 |

Maker pool should have a higher probability of making money in a bear, due to fact that traders are usually long, and since we are taking the short side, we make money. Is this over simplistic idea correct @orbitant ?

@Drillz I understand ur concern as do I, but I think over the long run the house always win, no?

Another thing, can we know how the APR of 23% is determined? This % is on the main page of https://maker.marginx.io

Am excited about this and hope we can find a way for more traders to know about Margin X.

The dynamics of the pool making money is confusing to me as well.The concept of buying FX with platform fee also works against you because in the case you want to swap them you will lose nothing less than 10 percent and couple that with when the maker pool makes a big loss in the same month.I think I will just have to step back till things are a bit more organized as I don’t want to use all my principal to pay debts incurred by market makers that tend to lose nothing and bear no risk.Over 6k personal loss in one epoch is not something I will like to see again.

Hi moleculeboost,

moleculeboost: Maker pool should have a higher probability of making money in a bear, due to fact that traders are usually long, and since we are taking the short side, we make money. Is this over simplistic idea correct?

This is incorrect, as market makers are supposed to function well in both bull and bear markets and thrive in volatile conditions.

- Market makers profit from the difference in the bid-ask spread.

- Market makers do not care if a trader longs or shorts, and they don’t influence prices.

- Their main role is simply to provide liquidity and depth while profiting from the spread.

moleculeboost: I think over the long run the house always win, no?

Market makers aren’t considered houses.

Market makers profit from the difference between the bid and ask spread, so it isn’t a house.

- Market-makers are risk-neutral and do not depend on traders’ performance to profit.

By definition, a house wins only when traders lose.

- This is GLP’s mechanism, which is technically different from MLP.

Thanks SCENE for sharing.

In general…

The role of market making is to provide liquidity to the market by offering bids and asks for a particular pair. This allows traders to buy or sell at any time, regardless of market conditions.

By providing liquidity to the market, market makers help to stabilize prices and reduce volatility. This makes it easier for traders to buy or sell without having to worry about price fluctuations or lack of available counterparties.

Market makers also help to narrow the bid-ask spread, which is the difference between the highest price that a buyer is willing to pay and the lowest price that a seller is willing to accept.

This makes trading more efficient and reduces trading costs for all participants in the market.

In exchange for providing liquidity, market makers earn a profit from the bid-ask spread.

They buy the contract at the bid price and sell it at the ask price, making a profit on the difference between the two prices.

Overall, market making plays a crucial role in an exchanges by providing liquidity, reducing volatility, and improving the efficiency of trading. By continuously quoting buy and sell prices, market makers help to ensure that there is always a ready supply of contracts available for traders to buy or sell, which helps to build trust and confidence in the market.

Market making involves risks, and there is always a chance of losing money. Market makers may face losses due to a variety of factors, such as adverse market conditions, unexpected events, or technical problems. However, the extent of these losses will depend on the market maker’s trading strategies, risk management techniques, and the overall market conditions.

One of the primary risks in market making is inventory risk, which is the risk of holding a large position in a particular asset that moves against the market maker’s position. This can result in losses if the market moves in an unfavorable direction.

Another risk in market making is market risk, which is the risk of losing money due to unexpected market events, such as sudden price movements or market crashes.

Overall, the chances of losing money in market making depend on a variety of factors, such as the market maker’s trading strategies, risk management techniques, and the overall market conditions. While there is always a chance of losing money, market makers can mitigate these risks by using appropriate trading and risk management strategies and staying informed about the market conditions.

Market makers is not the house.

@orbitant u explain things well. I now understand about maker pool clearly.

Let’s make sure others understand it too, also for AI pool if we can explain that too public will get increase interest.

Maker Liquidity Pool performance report (epoch 4 - full )

Summary

Maker liquidity pool makes a trading profit of $1070.30 (0.272%) on epoch 4 (but the maker pool is still suffer from previous losses)

The platform fee that distributed to all participants of maker liquidity pool is 43,497 $FX

The total debt pool of maker liquidity pool is -$26,040 (previous is -28,473) - the team deploys part of the platform fee and trading profit to offset the debt pool

Explanation of the platform fee distribution

The platform fee that attributed to Epoch 4 is around $8,059 , which is around 52,220 $FX

Due to the liquidity and trading volume of FX-USDT pool and the recent price drop, (spread >5% ), the team has decided to use its pool reserve to offer a better rate without fluctuate the market, hence Epoch 4 does not interact with fx-swap.

The team is also mindful that the previous debt on epoch 3, hence we decided to allocate 8703$FX (16.66% of 52,220 $FX) to payoff the previous debt pool. Thus, all maker liquidity pool participants shall share a total of 43,497 $FX proportionally.

Epoch:4

Duration: 16/4/2023 - 11/5/2023

Reporting Date: 11/5/2023

Part 1: Balance

| Address | Trading Pair | Initial Balance | Current Balance |

|---|---|---|---|

| 0xF937CE482E067B315446A1f63E48FFF599C788DB | BTC-USDT | 131,043.99 | 130,625.71 |

| 0x83ED913a3f7adC173f05e3bF60b5AA9dfaBFc3e6 | ETH-USDT | 133,564.40 | 133,271.50 |

| 0x17C2003c23604dC67845947A7514FddFB427cfe9 | FX-USDT | 127,812.58 | 129,594.61 |

| 392,420.97 | 393,491.82 |

Part 2: Key metrics

| Address | Trading Pair | Trading Volume | No. of Transactions |

|---|---|---|---|

| 0xF937CE482E067B315446A1f63E48FFF599C788DB | BTC-USDT | 22,407,350.00 | 10,530,928.00 |

| 0x83ED913a3f7adC173f05e3bF60b5AA9dfaBFc3e6 | ETH-USDT | 8,769,718.00 | 11,302,688.00 |

| 0x17C2003c23604dC67845947A7514FddFB427cfe9 | FX-USDT | 3,243,849.00 | 9,678,750.00 |

| 34,420,917 | 31,512,366 |

Part 3: Profit and loss

| Address | Trading Pair | Initial Balance | Current Balance | PNL |

|---|---|---|---|---|

| 0xF937CE482E067B315446A1f63E48FFF599C788DB | BTC-USDT | 131,043.99 | 130,625.71 | -418.28 |

| 0x83ED913a3f7adC173f05e3bF60b5AA9dfaBFc3e6 | ETH-USDT | 133,564.40 | 133,271.50 | -292.90 |

| 0x17C2003c23604dC67845947A7514FddFB427cfe9 | FX-USDT | 127,812.58 | 129,594.61 | 1,782.03 |

| 392,420.97 | 393,491.82 | 1,070.85 |

Part 4 Debt

The remaining debt on Epoch 3 is -$28,473

After deducting the trading profit on Epoch 4 ($1070) and $FX distribution ( $1363), hence the remaining debt on Epoch 4 is -26,040