Note: below is the summary transcript of the quarterly report, there might be minor grammatical discrepancies as you may watch the original video transcript for the best understanding. For the original video, you may watch it at Pundi X Q2 2021 Progress Report - YouTube

Dear Pundians,

Thank you for your time to participate in the Q2 2021 report. We’re going to update you on the progress we made and the lookout of Q3 2021.

Here’s the agenda of the Q2 report:

Watch the video here: Pundi X Q2 2021 Progress Report - YouTube

Joining us today is Joao Victor Mendes, who is the Head of Business Development of Pundi X and overlooks the LATAM market. Joao started off as one of the early community members and created the Pundi X Brazil Telegram group pre-ICO. He soon after joined Pundi X when talents were needed for the LATAM market, and has been with us ever since.

LATAM Market trend

Brazil by its population, landscape and culture, is suitable as a starting point for corporations to develop the Latin American market. For example, Ingenico has established a co-working space in Sao Paulo, Brazil, which is where our Brazilian office is located.

Pundi X Brazil is our gateway to the LATAM market.

The common situation in many Latin American countries is suffering from hyperinflation. Cryptocurrencies are used on a daily basis. Joao also shared that many unbanked, for example, people who come to Brazil for work from other countries, would need an easier and more affordable way to transact money back to their hometown.

Zac also shared his experience withdrawing local currency as a foreign traveler who has been to Argentina 2 times. Not only was the withdrawal fee high, it was also difficult to find an available bank that is approved by the local central bank for this kind of errands.

These reasons show great chances for Pundi X solutions to take part in the Latin American market by allowing people to acquire cryptocurrency as a way to hatch against the vulnerability of the local currency.

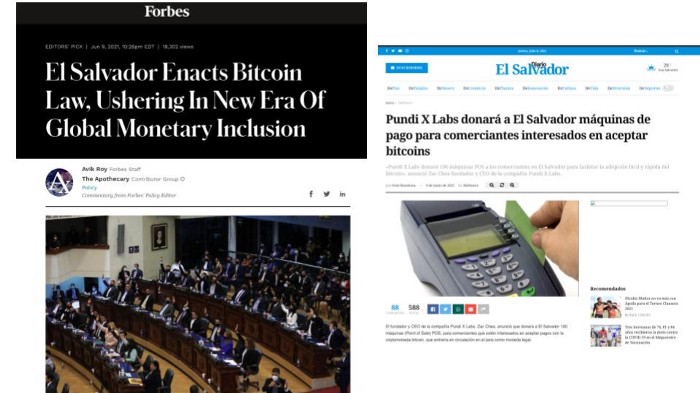

Development in El Salvador

Here are some questions asked during the AMA about the deployment in LATAM market:

Q1: Any update about the cooperation with Ingenico and BNP Paribas?

A1: The discussion continues but we are not able to reveal much.

Previously, most of the business opportunities we see in Latin America are from individual merchants or small businesses. However, we have seen big corporations like Ingenico looking into solutions that can add Bitcoin and blockchain to their portfolio services.

Q2: How many XPOS devices have Pundi X deployed in LATAM?

A2: As we have thousands of devices deployed globally, we do not share the exact numbers of each country. Some of the merchants do not wish to share their operation with XPOS due to the uncertainty of the regulatory landscape in the local markets.

Q3: What is the situation now of Pundi X and El Salvador? How many devices are you planning to deploy? And what’s MakerDAO’s role in this?

A3: We have already had calls with people from the El Salvador government. In fact, Pundi X has approached before the El Salvador Parliament passed the Bitcoin Law. The big pusher behind this is Mónica Taher, Technological & Economic International Affairs at the Government of El Salvador Trade & Investments Secretariat.

And MaerDAO has been our long-term partner in developing opportunities in the Latin American region.

The El Salvador government guarantees that all the Bitcoin merchants receive as payments will be converted to USD. This is a nice use case for DAI as Pundi X platform offers instant conversion of crypto currency to DAI, and vice versa.

Together with MakerDAO, we will be distributing devices to the local merchants.

Also, our distributor in Nigeria, U I Dabban, has donated XPOS Handy devices to El Salvador, a big shout out to the generosity.

Pundi X is now in the process of signing Letter of Intent with the El Salvador government, and at the same time dealing with logistics and arrangements for the devices to be shipped, which we believe will happen soon.

New XPOS use case in Turkey

Something we have been working silently on is the collaboration with our distributor in Turkey, OVO Dijital Servisler.

This is a new business model that transforms a money exchange into a crypto exchange office and provides services using Pundi X technology.

The very first crypto exchange is now open in Istanbul and more locations to be added to the map, which OVO shall be the one to reveal locations.

For more information, check out: Pundi X and OVO Dijital Servisler collaborate to bring easy crypto transactions in Turkey | by Pundi X (writers) | Pundi X | Medium

The endeavor of deploying XPOS will not end. As of now, we are working with distributors and potential distributors from Australia, Argentina, Belgium, Italy, Netherlands, and Thailand.

We are also seeing Argentina planning to follow the steps of El Salvador, which is what Pundi X would love to see, for we have been trying to get into the market since 2018. Initially, the business development was slow due to the uncertainty of the regulatory situation. However, we are now seeing movements from the governmental level.

Joao also added his point of view as a person working on the cryptocurrency field in Latin American market for 3 and a half years that, comparing to previous status, there has been aggressive changes of the mentality of the governments, politicians and authorities towards cryptocurrency.

Numbers of XPOS transactions in Q2 2021

It worths mentioning that ARRO is one of XPOS distributors in the US which the token has gained popularity among XPOS merchants in this quarter.

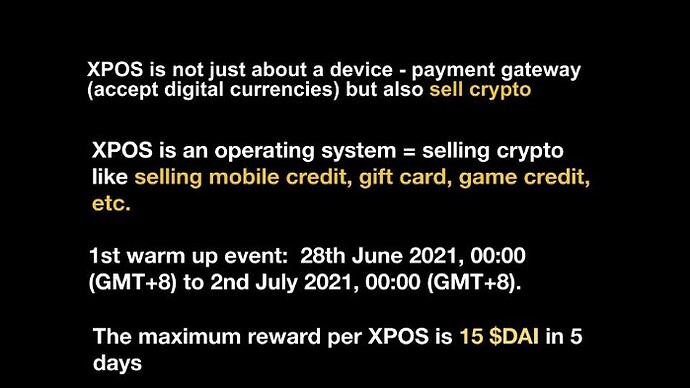

XPOS Transaction Mining

We have conducted a small scale of XPOS mining trail in late June. The purpose of the XPOS transaction mining is to make XPOS not only for payment but also selling other blockchain-based assets, which could be mobile credits, gift cards or game credits. This mining program is to motivate and reward XPOS merchants.

Function X Mainnet launched on July 6, 2021

After 3 years of hard work, the Function X Mainnet is finally live.

What we’d like to highlight is the relationship between Pundi X and Function X. While Pundi X focuses on the payment segment, which includes XPOS, XPASS and XWallet using crypto as a form of payment, Function X focuses on building the blockchain infrastructure. Both are interrelated and as our Community Manager, Indra, once said, “What is good for Pundi X is good for Function X, and vice versa.”

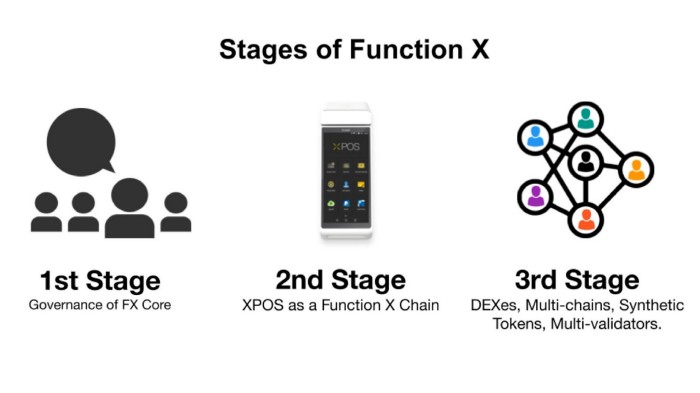

The first stage of the mainnet launch is Governance of FX Core, which allows the users to delegate their $FX to earn rewards and at the same time protect the network.

Read more about Governance of FX Core here: Function X: June Hash Out. Delegation on FX Core | by Danny | Function X | Medium

Check out the delegation status live: https://explorer.functionx.io/

At the second stage, XPOS will go on-chain. In fact, the entire payment system will go on-chain, which means all the transactions made with XPOS, XPASS and XWallet will be recorded on the Function X network.

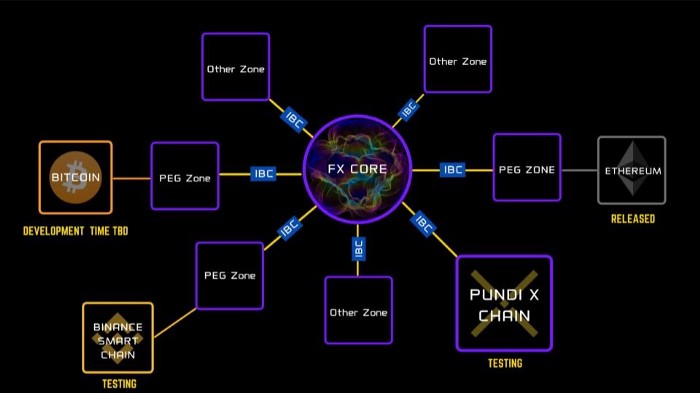

This leads to the Pundi X Chain. The FX Core is now connected to Ethereum, and we are now testing the cross-chain support between Binance Smart Chain, which is an existing, mature chain with many DeFi elements, and Pundi X Chain.

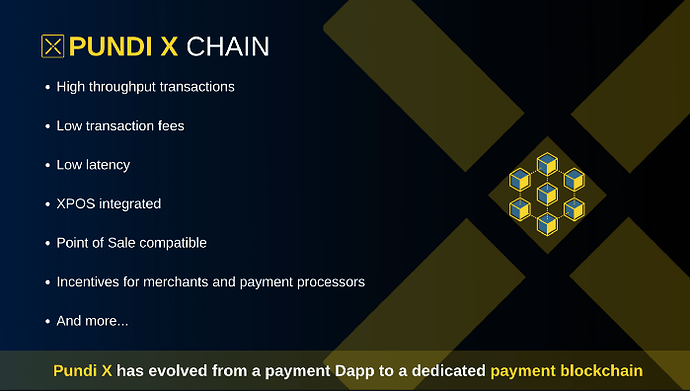

What will Pundi X Chain do?

Pundi X, both the project and the token will evolve from a payment service to a payment blockchain. What we’ve been doing will continue on a on-chain environment using our own blockchain.

Pundi X Chain will enable high throughput onchain transactions, low transaction fees, low latency, point-of-sale device compatibility as well as offering XPOS users incentives.

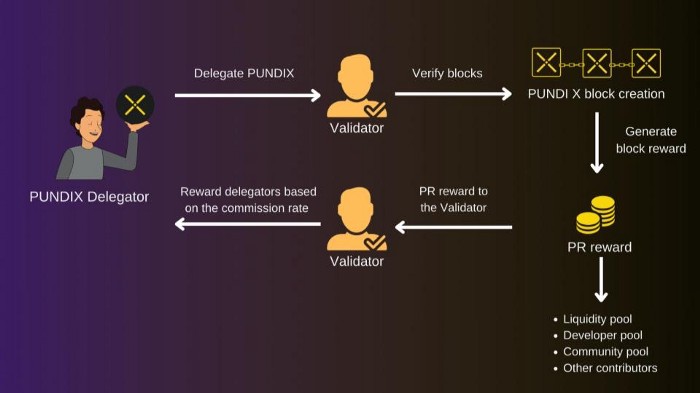

PUNDIX token holders will be able to delegate on the Pundi X Chain.

In order to encourage users to hold PUNDIX tokens on the Pundi X Chain, we will reward them with Pundi X Reward tokens. Some may ask why not just reward the holders with PUNDIX tokens? The answer is that PUNDIX token is a deflationary token and we cannot mint more PUNDIX token to the supply for reward but the opposite. Therefore, the token holders who hold and delegate PUNDIX tokens shall be rewarded with the reward tokens.

The delegation and reward flow will be as follows:

Pundi X Reward tokens are not for speculation but offers utilities such as buying XPOS, participating NFT auctions or receiving free NFT, redeem other tokens from the partners, receiving discounts…etc.

How we structure Pundi X Reward token will be a duo-directional token that will not only exist on the Pundi X Chain but also on the Binance Smart Chain.

Taking advantage of Binance Smart Chain will allow some of our users to tap into the liquidity and DeFi opportunities of Binance Smart Chain.

The design philosophy of Pundi X Reward Token is BDL.

The Pundi X Reward token is designed for people to hold the tokens, every transaction of the tokens will lead to 10% of token burn and 10% of distribution.

PUNDIX token holders will be rewarded with Pundi X Reward token. The calculation period starts from late June 2021 until the launch of Pundi X Chain.

For details of Pundi X Reward token, read here: Request for Comment: Pundi X Reward Token (Project name ‘PR’) | by Zac Cheah | Pundi X | Medium

Q2 2021 token removal

The next scheduled token burn will be on July 16th, 2021. As many have asked whether there will be more token buybacks initiated by the Pundi X management team, the answer is yes. We cannot promise when to buy back but we commit to conducting token buybacks when we see it fitss.

Some questions asked during the AMA about the Pundi X Chain:

Q1: What token will be needed to pay the gas fee for XPOS transaction on Pundi X Chain?

A1: When XPOS moves onto Pundi X Chain, all the transactions will be using the native token of the chain to pay the gas fee, in this case it will be PUNDIX token.

Q2: How many PUNDIX tokens are needed for validators on Pundi X Chain?

A2: The FX Core started with 20 validators and increasing, the Pundi X Chain will also start with a set amount of validators, which is 20. Because each validator has its voting power, we want to set a number of validators needed and then calculate the minimum amount of PUNDIX tokens each validator should have. It will not be too low for anyone to be able to become a validator but a suitable amount to kick off the validation process.

The opportunities we have in Latin American countries are not only the transaction requests, but also blockchain-based solution inquries. We are now in touch with some of these companies and exploring the use cases to see how Function X meets the demands.

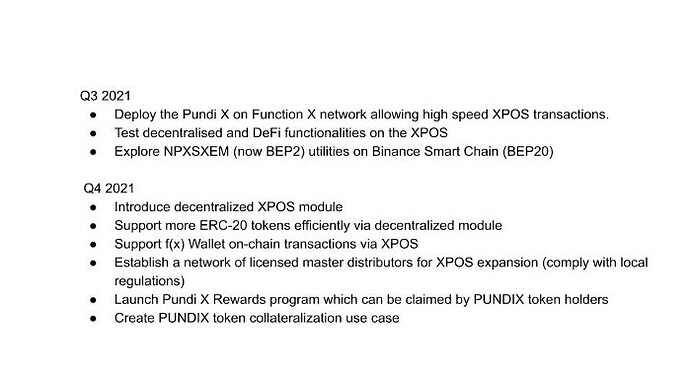

Here is the outlook of Q3 and Q4 2021.

In Q3, we will explore NPXSXEM by moving it to Binance Smart Chain along with Pundi X Reward token, the former will be absorbed into the latter, which means we will officially sunset the support of NPXSXEM tokens.

Once again, thanks for everyone joining this session live, especially those who staying up at night. Stay safe and stay good.