Dear Pundians,

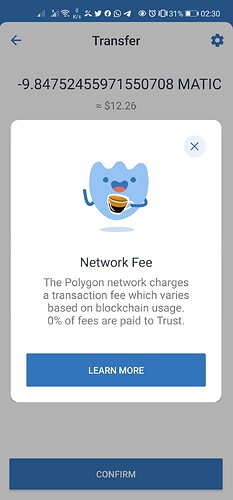

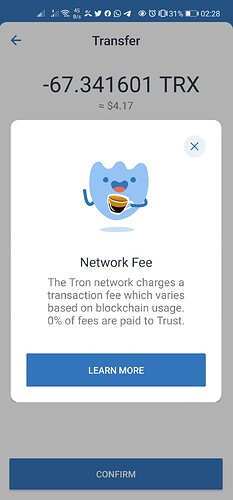

Web3 is all about decentralization and it applies the same to payment. We’ve launched XPOS in 2018 while the confirmation of onchain transactions was slow and expensive. Today more blockchain networks are available in the market, offering faster processing time and cheaper network fees. To ensure XPOS a future-proof solution for our merchants, it is also evolving with the advancement of the latest blockchain technology. Hence, by leveraging Function X infrastructure, deXPOS is here to assist the merchants to get ready for the Web3 revolution.

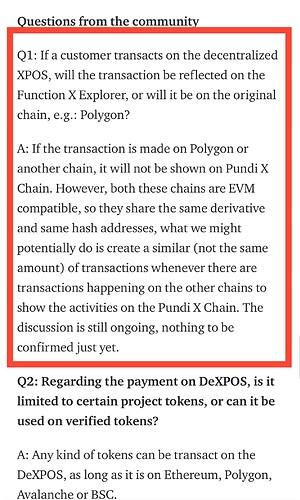

Currently, the deXPOS is under public beta testing and supports Ethereum, BNB Chain, Polygon and Avalanche C-Chain. We’ve already received feedback both publicly from the forum and privately through the one-on-one emails. A big thank you for your feedback! We are fixing the issues we’ve received and heading toward an official launch.

Here is the roadmap we plan to deliver for deXPOS. Please note that not all the features listed below could be delivered in time due to unexpected factors, such as logistic/shipment delay, security or compliance issues but we try our best to achieve.

Q2 2022: the launch of basic features

-

Use f(x)Wallet to authorize the transactions on deXPOS

-

Decentralized cashier and crypto sale modules, supporting onchain transactions on multiple blockchain networks

-

Offer 170+ world currency and crypto exchange rates

-

Filter and process refund of orders with errors

-

Basic management of deXPOS via f(x)Wallet

-

Decentralized XPASS card beta testing

-

Develop independent merchant back-end order management system

Q3 2022: new product integration

-

Official launch of Decentralized XPASS cards (a cold wallet solution)

-

Both f(x)Wallet and DeXPOS support the activation of DeXPASS cards

-

Offer DeXPASS card co-branding / customization

-

Launch Web3 back-end system for XPOS merchants to manage slippage tolerance between crypto and fiat currency

Q4 2022: Incentify the usage

-

Develop EVM for deXPOS

-

Launch transaction mining and incentive mechanism

-

Support point-of-sale devices made by other manufacturers 4. Support mobile devices and release deXPOS on Android and iOS app store

-

Set up the loyalty program

-

Set up community voting for coin listing

-

Set up the mechanism to meet the compliance requirement

2023: Expand the ecosystem

-

Support more blockchain networks

-

Release SDK to support 3rd party wallet, card issuers and online merchants

-

Explore subscription payment model with smart contract

-

Explore new applications for cold wallet

-

Explore the implementation of CBDC if available

As always, we welcome your feedback and comments. And buckle up for the web3 revolution that we bring to the payment space ![]()