Hi everyone,

Kevin here.

I am the new Social Media Data Analyst under the Marketing Team and hope we can have a good time and grow as a community. ![]()

![]()

For the first posting, I want to share some findings related to the impermanent loss(also called divergence loss) from our PURSE-BUSD LP Restaking Farm:

- What is impermanent loss(divergence loss)?

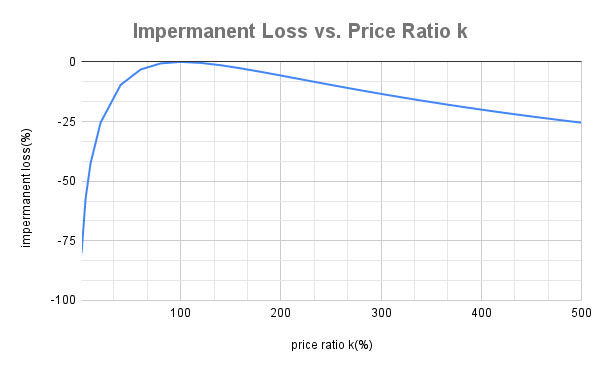

In short, it’s the percentage loss a liquidity provider could possibly experience (related to one being a HODLer) due to price divergence. For the relation between the impermanent loss and the token(PURSE) price ratio k:

Or we can read the plot this way:

a PURSE price loss of 20%(k = 80) results in a 0.62% loss related to HODL,

a PURSE price increase of 100%(k = 200) results in a 5.72% loss related to HODL,

…

For more detail, please visit the Medium articles written by Peteris Erins and Pintail.

- On what occasions can the LP Restaking Farm perform worse than Staking?

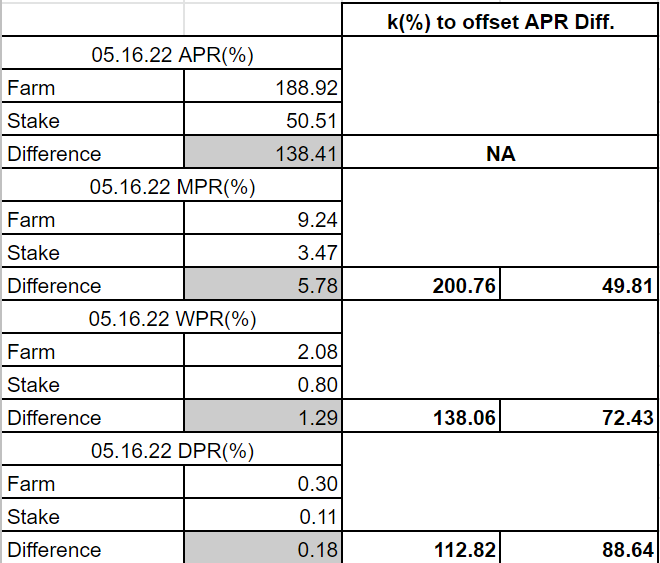

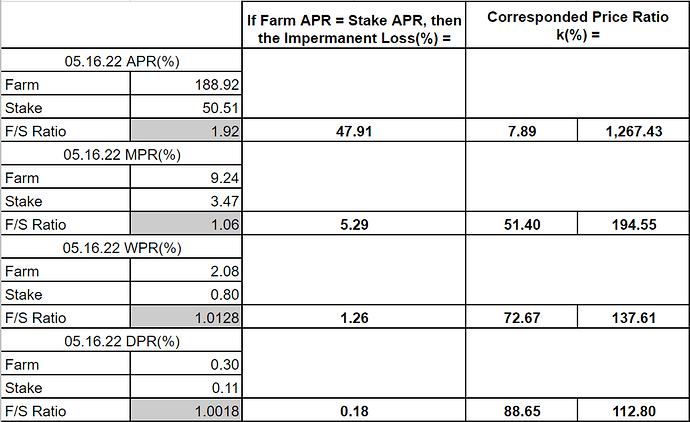

Based on the APR data on May 16:

(MPR = Monthly Percentage Rate based on the APR, WPR = Weekly Percentage Rate based on the APR, DPR = Daily Percentage Rate based on the APR)

The above table only consider the influnce of impermanent loss.

We can also put it another way:

if Bob decided to become a PURSE-BUSD liquidity provider today and after one month a PURSE price increase of over 100.76% or a loss of over 50.19%(k >= 200.76 or k <= 49.81) happens, then he can get better APR by just putting money in Staking

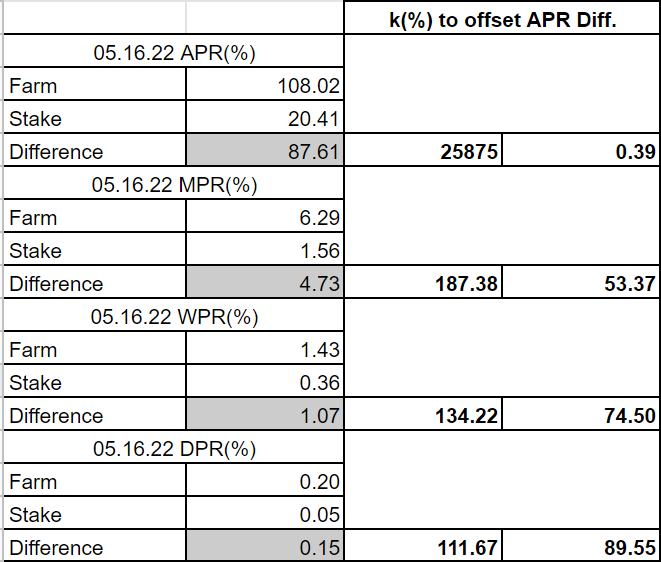

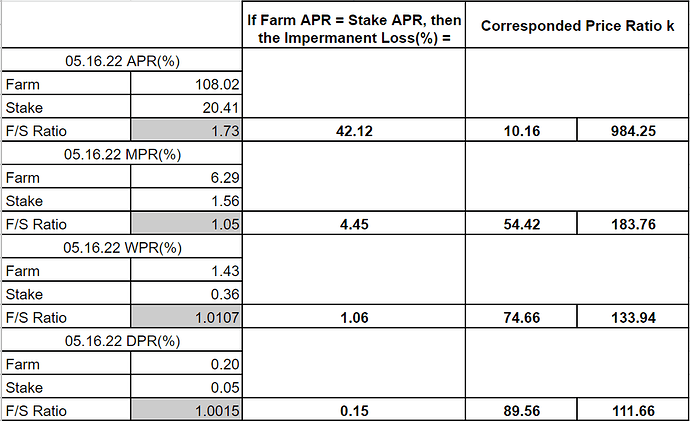

If we also consider the BDL mechanism of PURSE:

(MPR = Monthly Percentage Rate based on the APR, WPR = Weekly Percentage Rate based on the APR, DPR = Daily Percentage Rate based on the APR)

It’s obvious the APR difference between Farm and Staking is smaller.

- How long will it take to earn my loss from the BDL mechanism back?

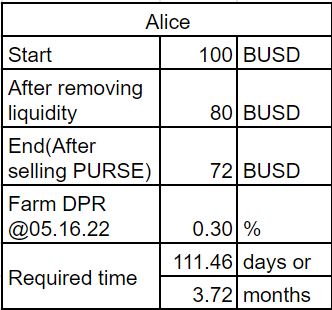

Let’s consider a situation here:

Alice decided to put 100 BUSD into the PURSE-BUSD liquidity pool but oddly she aims to cash out 100 BUSD too after removing the liquidity and selling PURSE from the removing. How many days will it take for this to happen?

Let the DPR equals the number from the second part of the article(0.30%) and the APR is constant throughout one month, then we can get:

It requires 111.46 days or 3.72 months to cash out 100 BUSD.

To put it another way, it takes over 111.46 days to make actual profit!

How do you feel about this first episode?

Many thanks to @zaccheah for the inspiration for this article.